Ketchikan seniors have strong opinions about changes to the federal Social Security program. Like many other Alaskans, they’re worried whether Congress will maintain or reduce their benefits as the number of retirees increases.

About 70 mostly retired people sit around meeting room tables at Ketchikan’s Landing Hotel. They’re here to learn about changes that could affect a key part of their income.

“So let’s jump into the first one. And what we’re going to do is we’re going to talk about Social Security. Is it just a math problem?” asks Daryl Royce, AARP Alaska’s director of community outreach.

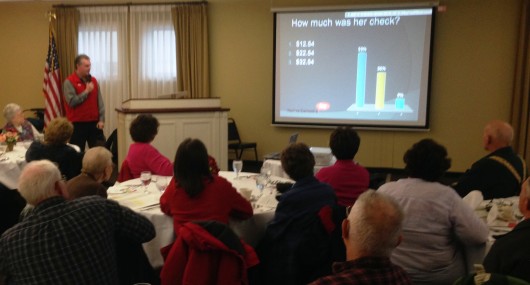

“So what we have here is this gap between this line and this line. That is the solvency gap,” he says, pointing to a graph projected on a screen.

Royce and other AARP staffers have been traveling the state, talking to retirees – and those thinking about retirement. (Link to the AARP advocacy website on Social Security and Medicare changes.)

He says unless something changes, Social Security will be have to start cutting benefits about 20 years from now.

The goal, in these presentations, is to discuss a number of proposals that could help fix that.

“There seems to be this idea that Social Security won’t be there for me. And we want to make sure we’ll be able to say, ‘No, it will be there for you.’ There are some adjustments that need to happen to it. But it will be there for you if certain steps are taken,” he says.

Among those steps: Increasing the age for receiving full benefits to either 68 or 70 over a number of years. Almost three-quarters of those at Ketchikan’s meeting were in favor.

About 60 percent supported another proposal: raising payroll taxes.

Just under 30 percent wanted to require all new government employees to pay into the system. About a quarter of the state and local government workforce, including many in Alaska, have opted out.

And only about 15 percent wanted benefits to be paid based on need.

Royce says he’s heard similar answers from around the state.

“It’s very typical, especially around issues of taxation. Very much we’ll see a divided group because there are fundamental differences on that issue,” he says.

Another idea would modify Social Security to pay monthly benefits as lifespans increase. Yet another would change the way the cost of living adjustment is calculated.

Most attending this particular presentation were near, at or past retirement age.

But Royce stresses that half of AARP’s members are still in the workforce. And they have questions too – because they’ll be the most directly affected.

“Right now you hear a lot about the Social Security Trust Fund being broke. And, it isn’t broke. But it does a have a problem in the future paying 100 percent of the benefits,” he says.

Of course, Ketchikan seniors, or Alaskans as a whole, won’t be the only ones deciding how to fix the problem.

“These are earned benefits, and we want to make sure that people understand they have a say in the future of these programs,” he says.

Royce encourages everyone to learn about the proposals and voice their views on the plans that could become part of a Congressional package to fill the Social Security gap.